Hi,

I'm Vipul, and this is Leeds1888 - Issue 46, your one-stop newsletter to get news and insights on the things that matter from the world of media and entertainment. Last week, I received 102 emails with questions around the Global Media Devices market. If you haven't read it yet, I recommend doing so at https://leeds1888.beehiiv.com/p/leeds1888-issue-45.

Have you checked out the new AI tool for creators called Veda by Mugafi !

This edition of Leeds1888 is proudly sponsored by Mugafi.com, India's pioneering AI-powered creator platform with a mission to democratise the creator economy.

This newsletter will cover the following sections:-

Top OTT Shows & Movies (don’t miss the new entrants)

Is Disney looking to Sell its India Streaming Business?

Weekly Box Office report

News Buzz

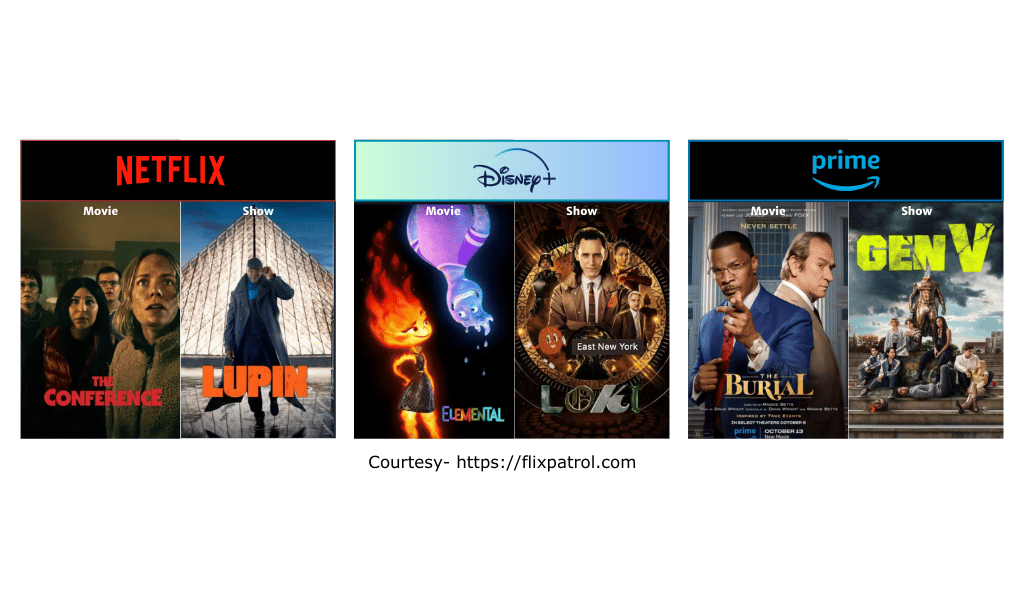

Top watched OTT Shows this week

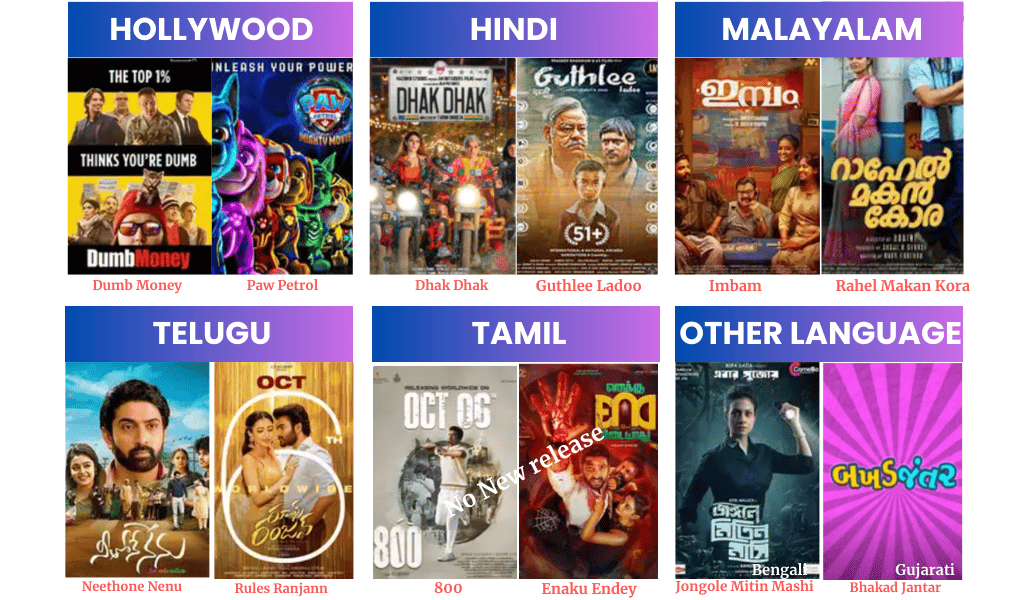

Top Releases this week

Why is Disney looking to sell its India Streaming Business?

News is circulating on various online portals about Blackstone engaging in discussions with Disney to acquire its stake in the streaming service (Disney+Hotstar) and its television business.

For many, this development may come as a surprise, as Disney+Hotstar stands as the leading OTT platform in India, boasting more than 58.4 million active subscribers. This figure places it ahead of other providers such as Amazon Prime and Netflix, as outlined in the OTT Platform Market Report.

Moreover, Disney's TV channels hold significant popularity in India, particularly among children. Additionally, Disney+Hotstar serves as the official broadcaster for this year's World Cup cricket matches, resulting in a substantial increase in subscribers, thanks to ongoing match viewership.

The significant question at hand is: Despite being the market leader, why is Disney considering divesting its India business? This decision is particularly puzzling given the prevailing sentiment within the entertainment industry, which is that India is rapidly emerging as one of the fastest-growing and largest markets in the world.

Lets Set the Context

A glimpse of Disney’s India Portfolio.

A bouquet of over 70 channels, including the Star TV network, featuring Star Sports, National Geographic, and popular kids channels like Cartoon Network.

A 30% stake in Tata Sky.

A 74% stake in the Pro Kabaddi League.

The Disney+Hotstar Streaming Network.

UTV, Bindaas, and Hungama TV Network.

This portfolio constitutes a substantial and diverse collection of assets, including TV channels, sports holdings, digital content libraries, and streaming services. In 2022, these entities generated over $2 billion USD for Disney, marking a remarkable 38% increase over the previous year. However, it's intriguing to note that despite such a prolific business presence in India, the country's annual contribution to Disney's global revenue is just over 2 percent. In 2022, Disney's global revenue surpassed $82 billion USD.

Now, let's shift our focus to Blackstone.

Blackstone is the world's largest Alternative Asset Manager, overseeing $1 trillion USD in assets. The company is renowned for executing leveraged marquee buyouts over the past three decades.

With an understanding of the involved parties, let's delve into Disney's business operations in India and explore why a business that appears substantial from the outside is facing significant challenges.

What’s Brewing at Disney’s India Business?

The story begins in the U.S. Disney's stock has nearly halved from its peak this year, and Disney's management faces immense pressure to divest from loss-making or troublesome businesses in its global portfolio. In his second term, Bob Iger, aged 72, who was brought back as Disney CEO eight months ago and has committed to staying until the end of 2026, has grappled with turning around the entertainment giant. The streaming business continues to accrue losses, while legacy TV networks struggle to compete with new-age entertainment.

Although the COVID-19 years of 2020-21 witnessed substantial growth in content consumption on TV channels and streaming platforms, the year 2022-23 has presented a different narrative altogether.

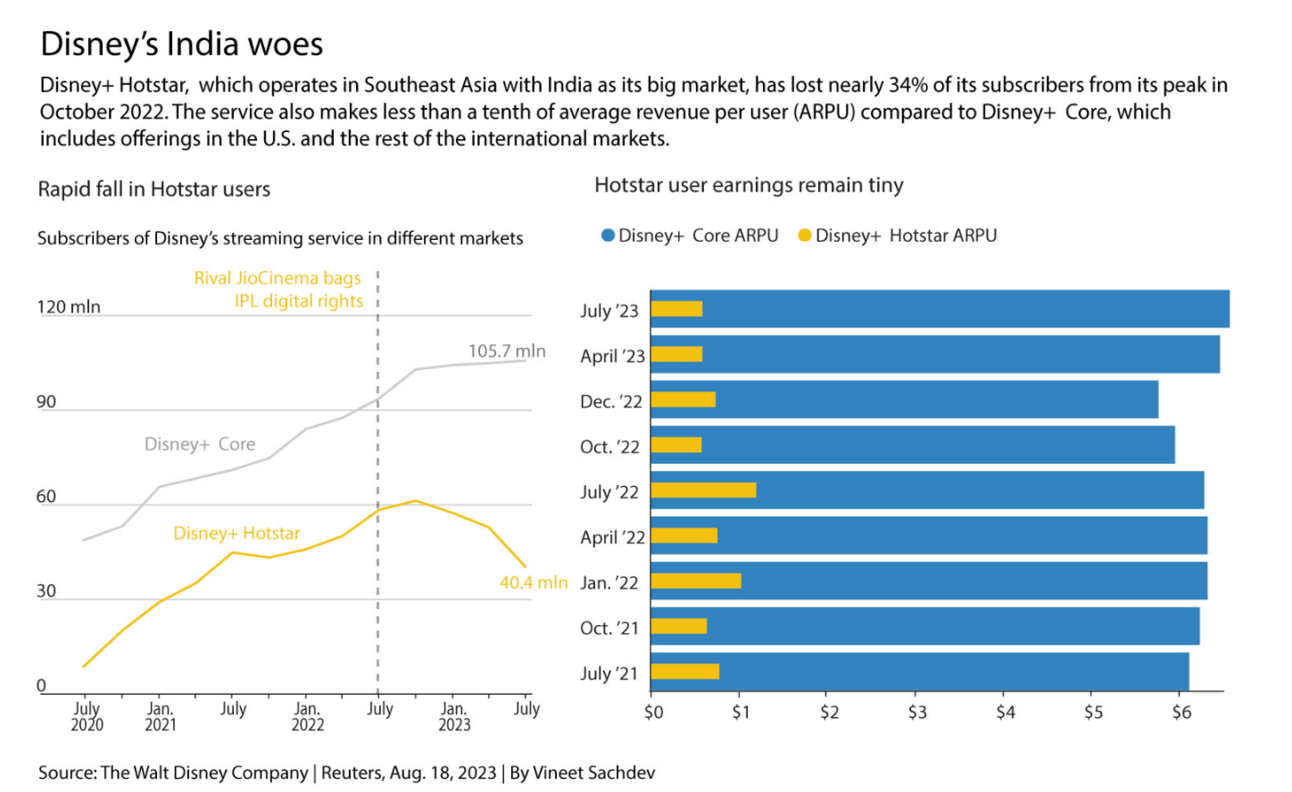

Dismal figures on the charts indicate that Disney's Star India portfolio revenue is expected to decline by more than 20% this year.

It is estimated that EBITA for 2023 will decrease by over 50%.

Despite securing the rights to broadcast the World Cup Cricket matches, Disney lost the bid for the Indian Premier League (IPL). It is projected that Hotstar will lose 8-10 million subscribers in 2023.

The company is poised to lay off nearly 5,000 employees as part of its global cost-cutting measures.

Other Key Factors

Native OTT players

Emergence of Jio Cinemas as one of the native OTT platforms is a huge cause of concern for Disney+ Hotstar. Jio Cinema is part of Viacom18 which has opened up a huge content repository of hit shows and movies for Jio.

High Cost of Content Acquisition

Disney Stars online streaming and TV channel businesses are spending crazy amounts of money for content acquisition and to get the ownership rights for the major sports events like the ICC Men’s Cricket World Cup. At an operating level Disney made a loss of $41.5 Million USD against a revenue of $390 Million USD in 2022.

Summary

As we can see from the image above ( report published in Reuters), the lower Average Revenue per User ( ARPU) for Disney+Hostar is less than 10% as compared to the total revenue of Disney +Core and with the rising cost of content, it makes a compelling case for Disney to consider partnering with other business houses of completely offloading the low margin businesses in India.

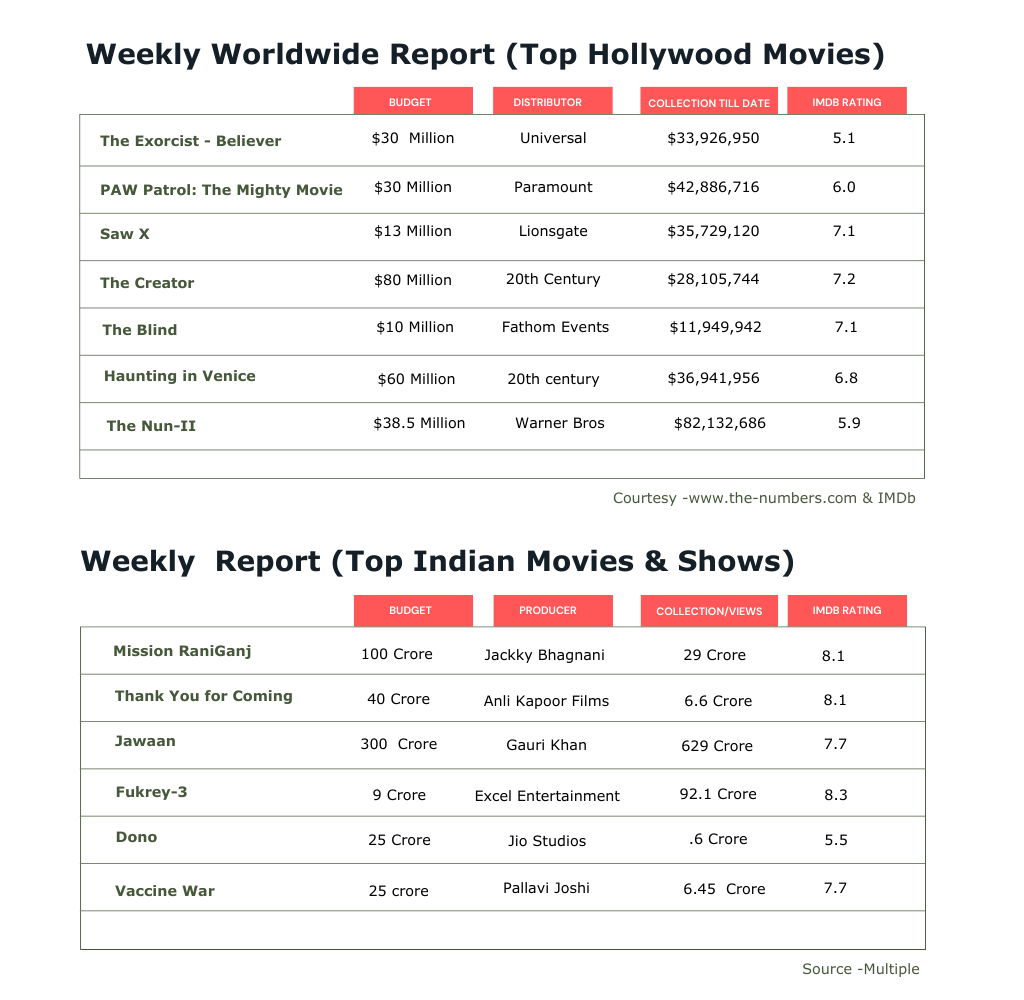

Box Office Collection Report

News Buzz !

And with that, it's a wrap on this edition of Leeds1888. Please share this newsletter within your network and let's grow our community !

Vipul