Hello,

Welcome to Leeds1888, Issue-37. Hollywood is currently quiet due to an ongoing strike, resulting in minimal buzz. As part of our earnings season coverage, I've been sharing insights about major US Media Companies, discussing their growth and legacy challenges. In this edition, I'll continue along the same lines, delving into how ESPN, once a cash cow for Disney, has transformed into its biggest liability.

I'm grateful for your continuous encouragement and support for this newsletter. For newcomers, I cover significant events and offer valuable insights from the realm of media and entertainment.

Also I am working towards democratising the creator economy through my venture www.mugafi.com. Do checkout the site to know more about the exciting things unfolding at Mugafi.

The Highlights of this week's issue

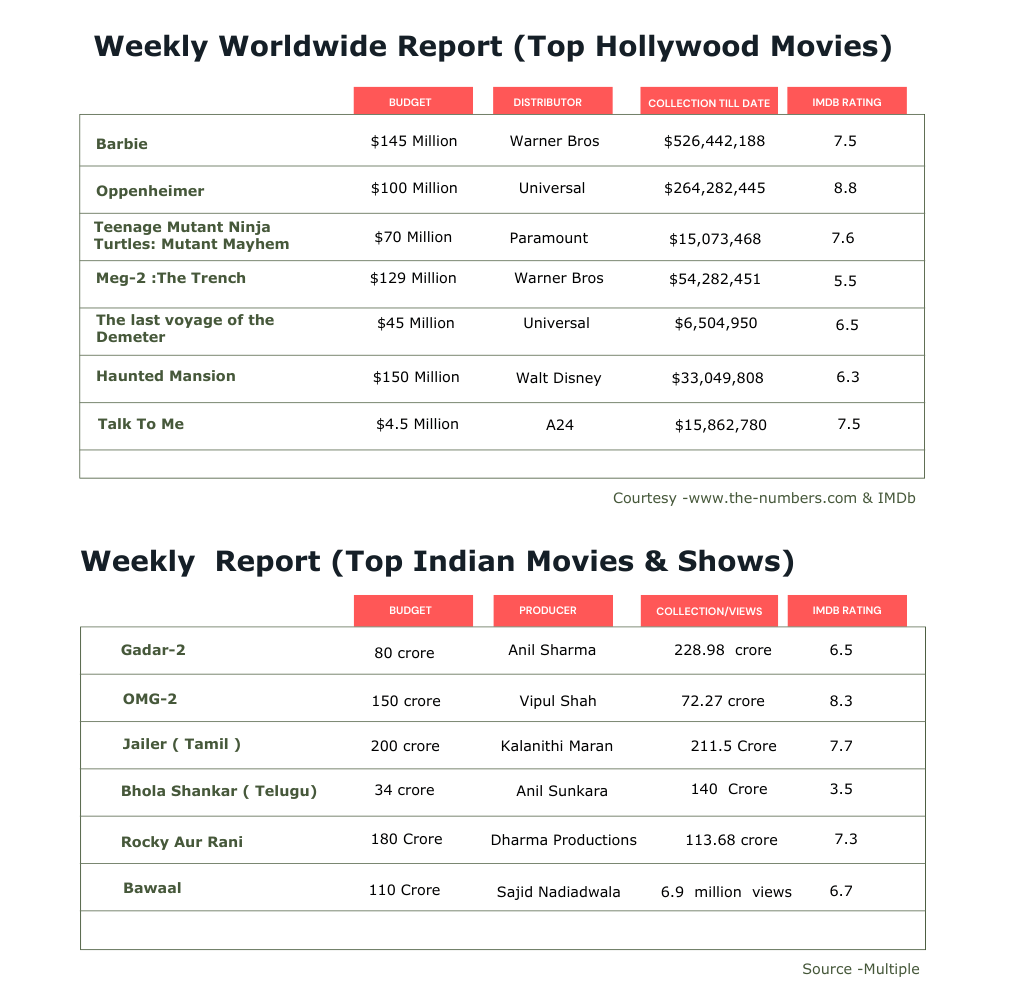

Top OTT Shows & Movies (don’t miss the new entrants)

Why is ESPN burning money for Disney?

Weekly Box Office figures.

Weekly Puzzle

News Buzz

Top watched OTT Shows this week

Top Movie releases this week

Why is Disney Selling Stake in ESPN?

Dinsey-ESPN - The Origins

It's widely recognized that ESPN holds a prominent position in sports broadcasting worldwide. Concurrently, Disney stands as the preeminent force in the entertainment and film production industry. Back in 1979, Bill Rasmussen founded ESPN Inc., envisioning a platform to air Connecticut sports through a cable channel named "Entertainment and Sports Programming Network" (ESPN). This humble beginning swiftly evolved into a nationwide cable sports network. Disney's acquisition of ESPN took a different route—it acquired Capital Cities/ABC, ESPN's majority owner, on August-1, 1995, for a staggering $19 billion.

Disney’s Financial Powerhouse for 30 years

For a solid three decades, ESPN has functioned as a lucrative cash cow for Disney. Over this extended period, ESPN's growth has been fuelled by the escalating popularity of major sports leagues in the USA and globally. Capitalising on its dual revenue stream from both cable subscription fees and advertising, this sports powerhouse continues to generate billions of dollars in profits for Disney. In the initial half of the 2023 fiscal year, Disney's cable networks division, anchored by ESPN and its associated channels, amassed a revenue of $14 billion and a profit of $3 billion. The funds from ESPN proved instrumental in Disney's ability to finance acquisitions such as Marvel, Lucasfilm, Pixar, and 21st Century Fox.

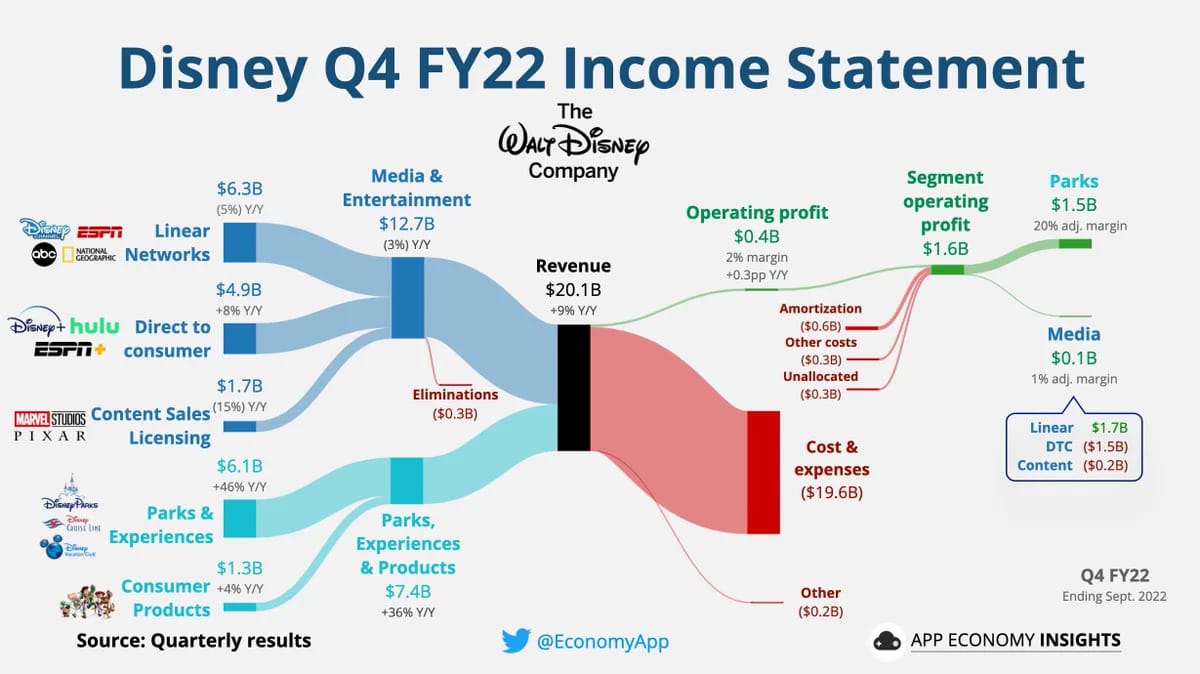

The revenue distribution outlined above underscores the substantial impact of ESPN and its network on Disney's overall revenue expansion.

The Problem

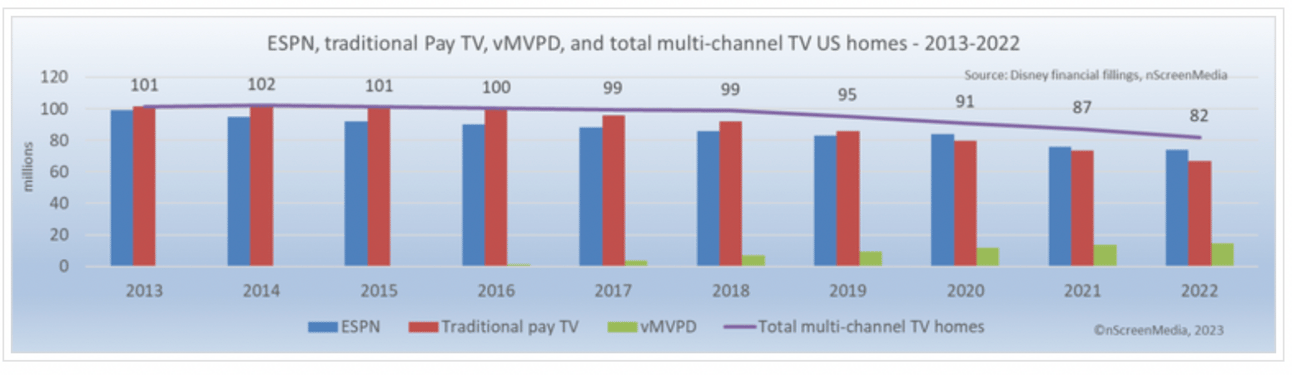

As discussed earlier in this piece, ESPN's growth was primarily fuelled by its dual-revenue structure, with one stream being cable TV subscriptions. However, with the emergence of streaming platforms, the entire cable TV sector is experiencing a fundamental transformation. Traditional cable TV is gradually declining on a global scale, and its influence within the USA is particularly significant.

Over the last six months, there has been a 6% reduction in revenue and a 29% decrease in overall profits for traditional cable TV. Additionally, the count of paying subscribers for ESPN has been consistently diminishing over the past several years.

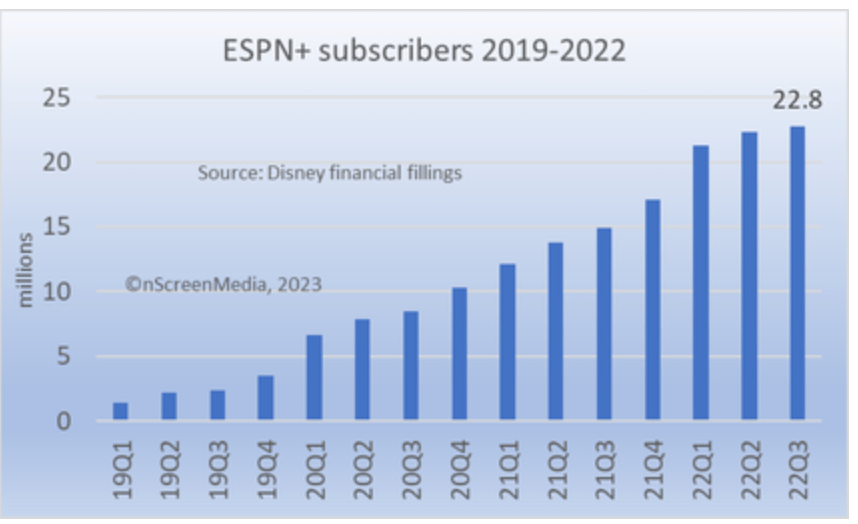

However, it's intriguing to observe that during this period, the ESPN+ streaming service has been consistently attracting a growing number of subscribers.

Mounting Pressure on Disney

Lately, Disney's stock has faced significant pressure due to disappointing box office performance of certain movies, increasing losses in the streaming sector, and production stoppage caused by the ongoing WGA strike. Within this atmosphere of uncertainty, the decline in ESPN's growth has contributed to Disney's concerns.

As a response, Disney is currently considering the option of divesting a portion of its stake in ESPN. This move aims to mitigate losses and potentially bring in a strategic partner who can contribute expertise in content creation and distribution.

A Twist in the Tale

When Disney acquired a significant stake in ESPN, it didn't anticipate the transformative influence of technologies like the internet on broadcasting and content consumption. This miscalculation is understandable, as the modern internet landscape didn't resemble its present form at that time. Currently, Disney is contending with the consequences of this oversight.

Nonetheless, it seems that Disney's leadership is adopting a forward-looking perspective. Their recent $2 billion agreement, allowing the use of their brand in Penn Entertainment's online Sportsbook, can be seen as a strategic shift by Disney to leverage the rapid expansion of the sports betting sector. This move heralds the establishment of ESPN BET. Nevertheless, the consideration arises: with ESPN having been synonymous with authentic sports coverage for over three decades, will entering the domain of potentially manipulative online sports betting tarnish its brand reputation? Only time will provide the answer.

Conclusion

The magnitude of the wager corresponds to the scale of both the potential gains and losses. As a corporation expands into a substantial global entity, this principle becomes increasingly pronounced. For Disney, ESPN stood as an ideal gamble, yielding significant dividends over the past three decades. However, the advent of technology has disrupted the cable TV sector, necessitating a reconsideration of strategy with a primary focus on technology and content moving forward.

Box Office Collection Report

Quiz Time

Today’s quiz is inline with the main article of the newsletter.

Q. Disney holds around 80% in ESPN network. Which is the other major stakeholder in the network?

Hint:- This company also owns this famous magazine

News Buzz!

Hollywood strikes have already had a $3 billion impact on California’s economy, experts say: It’s causing ‘a lot of hardship Read more here

With an eye to tap into the growing gaming market, Netflix begins testing its games on TVs and computers in Canada and U.K. Read more here

And with that, it's a wrap on this edition of Leeds1888.

Vipul